If you think your CPA is handling all your accounting needs, you might be surprised to learn there’s a gap in what you’re getting. Most CPAs excel at tax preparation and compliance, but that doesn’t mean your books are set up to help you run your business effectively.

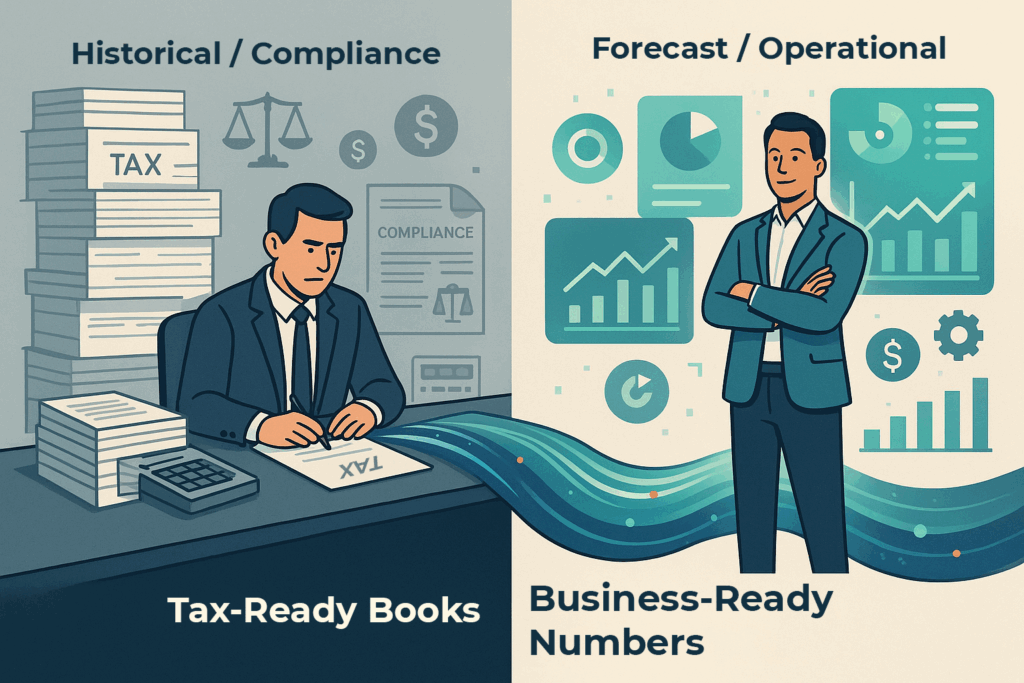

At many firms, the focus stays on getting your taxes filed correctly and keeping you compliant with regulations. However, there’s a significant difference between tax-ready books and numbers that actually support business decision making. Understanding this distinction can transform how you use your financial information.

The Reality of CPA Limitations

Your CPA likely does excellent work within their specialty. They understand tax codes, know compliance requirements, and can navigate complex regulations. However, many traditional accounting firms structure their services around annual tax cycles rather than ongoing operational accounting needs.

This creates a disconnect. Your business operates daily, but your financial insights may only come quarterly or annually. By the time you receive reports, opportunities have passed and problems have grown.

Common limitations include:

Recording transactions for tax purposes rather than operational insight

Focusing on historical data instead of forward-looking information

Creating reports that satisfy compliance but don’t support day-to-day decisions

Using classifications that work for tax filings but obscure business performance

Tax vs Operational Accounting: Two Different Goals

Tax accounting follows specific rules designed for compliance and standardization. The goal is accurate reporting to government agencies and ensuring you pay the correct amount of taxes.

Operational accounting focuses on information that helps you manage your business. It’s about understanding cash flow patterns, identifying profitable services, and supporting strategic decisions.

Consider these examples:

A landscaping company might record all equipment purchases the same way for taxes, but operationally needs to separate maintenance equipment from revenue-generating tools to understand profitability by service line.

A consulting firm may group all business meals together for tax purposes, but operationally should separate client entertainment from team meetings to track true client costs.

Your CPA handles the tax side expertly. The question is whether anyone is addressing the operational side.

What Business-Ready Numbers Look Like

When your accounting system supports business decision making, you get timely, relevant information that matches how you actually run your company.

Examples include:

Job profitability reports that show which clients or projects generate the best margins

Cash flow forecasts based on your collection patterns and payment schedules

Department or service line reporting that reveals which parts of your business drive growth

Vendor analysis that identifies opportunities to negotiate better terms or find alternative suppliers

These reports use the same underlying data as tax filings, but they’re organized and timed to support real business needs. The goal is financial clarity that leads to better decisions, not just compliance.

Bridging the Gap

The solution isn’t necessarily finding a new CPA–it’s understanding what you need beyond tax preparation and making sure someone addresses those needs.

Some approaches that work:

Expand Your Team: Keep your CPA for taxes and compliance, but add resources focused on operational reporting and analysis.

Ask for More: Discuss your operational needs with your current firm. Some CPAs can provide management reporting services, though it may require different pricing and timing.

Use Technology: Modern accounting software can generate operational reports automatically, reducing the need for manual analysis.

Invest in Understanding: Learn enough about your numbers to ask the right questions and identify when reports don’t match your business reality.

Making the Most of Both Worlds

You need both tax-ready books and business-ready numbers. The key is recognizing they serve different purposes and may require different approaches.

External reporting and tax compliance remain critical–they protect your business and satisfy legal requirements. However, limiting your accounting to these functions means missing opportunities to use financial information as a competitive advantage.

At Fusion Accounting and Technology, we see this challenge regularly. Business owners often struggle because their accounting serves compliance but doesn’t support growth. That’s why we help design systems that handle both needs effectively.

The cost of poor financial information extends beyond missed opportunities. It includes inefficient operations, delayed responses to problems, and decisions made without adequate insight.

Don’t assume your current accounting setup serves all your needs. Evaluate whether your numbers help you run your business or just keep you compliant. The difference can determine whether your accounting function becomes a strategic asset or remains a necessary expense.

Have questions about making your accounting work harder for your business?

Let’s explore how to turn your financial data into a competitive advantage.